Photovoltaic Glass | Supply and Demand Logic Fails? The Photovoltaic Glass Industry Welcomes a "Stockpiling Boom"

Jul 23,2025

The current photovoltaic glass industry is experiencing a complex and contradictory market phase: On the one hand, policy-driven price increases of raw materials, coupled with expectations of a traditional peak season, are stimulating hoarding behavior among downstream component manufacturers, causing photovoltaic glass prices to rebound from their expected bottom; on the other hand, the industry still faces severe supply and demand contradictions, high inventory pressure, and structural difficulties in the lack of substantial improvement in end-market demand. This situation, where superficial prosperity and deep-seated challenges coexist, is a microcosm of the difficult struggle of the photovoltaic industry chain in the context of energy transformation.

Price rebound from the bottom and hoarding boom under policy stimulus

The photovoltaic glass market experienced dramatic price fluctuations in 2025. Prices, which had been continuously falling in the first half of the year, recently showed signs of a rebound from the bottom. This phenomenon is the result of multiple factors working together.

First, the current industry price is basically the historical lowest price. According to research data from Longzhong Information, the current price of 2.0mm single-coated (panel) photovoltaic glass is roughly between 9.5 and 10.5 yuan/square meter. This price level is even lower than the cash cost of second-tier enterprises, forcing some production capacity to exit the market. The price falling below the "survival line" has created the conditions for a subsequent rebound.

Comparison chart of photovoltaic glass 2.0mm single-coated (panel) price trend in 2024-2025 (yuan/square meter)

Secondly, policy factors: The High-Quality Development Conference of the photovoltaic industry held on July 16, 2025, clearly required enterprises to implement full-cost pricing, with the tax-inclusive full cost of silicon materials set at 43.874 yuan/kg, and the guiding price of silicon wafers also increased accordingly. This policy significantly increased the expected cost of main materials for components, indirectly strengthening the market's prediction of a rise in the price of auxiliary materials. Under the deterrence of the policy, disorderly low-price competition in the industry has been curbed, creating a policy environment for the price of photovoltaic glass to return to rationality.

Thirdly, combining seasonal factors, the industry believes that there is an expectation of increased demand in September-October. From the analysis of past seasonal trends, the industry often experiences a short-term rush installation peak season at the end of the year. Therefore, the anticipated seasonal demand has also become one of the reasons for stimulating stocking behavior. Downstream component manufacturers have increased their procurement of photovoltaic glass since late July to cope with potential peak season demand, resulting in passive hoarding.

In summary, the current "hoarding phenomenon" is a situation where, when prices approach historical lows, the market generally forms an expectation of "no further decline," and the psychology of buying at the bottom drives purchasing behavior. However, this "hoarding-style prosperity" masks the weakness of real demand and has sown hidden dangers for the industry. The supply and demand contradictions faced by the photovoltaic glass industry are long-term accumulated structural problems with profound industrial background and institutional roots. Even under the current high enthusiasm for hoarding, the problem of overcapacity still lingers, becoming the biggest obstacle to the healthy development of the industry.

First, there is no expectation of actual improvement in end-market demand. On the one hand, China, as the largest producer and consumer, has slowed export growth due to trade barriers in Europe and the United States; on the other hand, domestic installations are constrained by power absorption capacity, and grid connection and power absorption of distributed photovoltaics have become the main contradiction, restricting the release of photovoltaic glass demand.

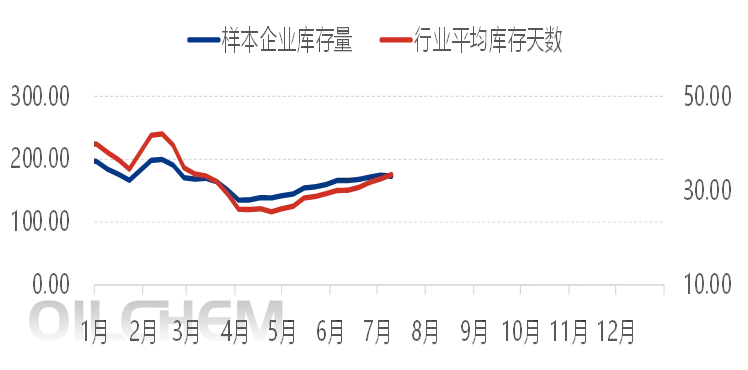

Secondly, the industry has a high inventory problem: According to data from Longzhong Information, the inventory of photovoltaic glass sample enterprises this period is 1.6626 million tons, a decrease of 3.77% compared to last week; the average industry inventory days are 32.52 days, a decrease of 0.89 days compared to last week, significantly higher than the safety inventory line of 30 days.

Weekly inventory and inventory days of photovoltaic glass sample enterprises (ten thousand tons, days)

Faced with the severe supply and demand situation, the industry has begun to adjust spontaneously. The industry has started a new round of production cuts. As of now, the latest daily melting capacity has dropped to 88,250 tons/day. Although supply has been reduced, from the demand perspective, the problem of oversupply has not yet been solved. Therefore, the future direction of price increases may lean towards the industry's cost side under the influence of policy, but only when the supply and demand problem is reasonably resolved can the industry achieve substantial profitability.

The current heat in the photovoltaic glass market is largely a false prosperity driven by hoarding in the midstream, and the actual demand from terminal power stations has not seen any substantial improvement. This phenomenon of decoupling between upstream and downstream reflects the deep-seated challenges facing the photovoltaic industry during energy transformation. Faced with multiple challenges such as price fluctuations, supply and demand imbalance, and weak end-market demand, the photovoltaic glass industry urgently needs to formulate systematic coping strategies, both to alleviate short-term operational pressure and to plan for long-term sustainable development paths. Breaking through the industry's predicament requires the concerted efforts of enterprises, industry associations, and policymakers, using a three-pronged approach of supply optimization, demand development, and efficiency improvement to overcome the difficulties.

With the deepening of the "dual carbon" goals, the proportion of photovoltaic power generation in the energy system will continue to increase, and the long-term demand for photovoltaic glass remains positive. However, the industry must overcome the current structural adjustment pains before it can usher in a new stage of high-quality development. Enterprises that have made forward-looking layouts in technological research and development, production capacity layout, and business models will occupy a favorable position in the next round of industry growth cycle.

PREVIOUS:

Contact Us

E-mail: admin@jingtaibl.com

TEL: +86 18969476297 / +86 18067898952

Address: No.56, No.2 Donggang Road, Quzhou, Zhejiang Province